-

Benefits open enrollment for 2025–2026 is now closed. You may be eligible to change your elections if you meet certain criteria. Check eligibility.

Health Savings Accounts

-

A Health Savings Account (HSA) is a great way to help you control your healthcare costs. It works in conjunction with a qualified High Deductible Health Plan (HDHP) to combine tax-free savings earmarked for qualified medical expenses. An HSA allows you to set aside money to pay for higher deductibles associated with a lower monthly premium HDHP. The money you save in monthly insurance premiums is reserved for eligible medical expenses you incur in the future. Eligible expenses include things like co-pays and deductibles, prescriptions, vision expenses, dental care, therapy and medical supplies.

Highlights

-

- Balances roll over from year to year and earn interest along the way.

- Portable – you keep it even after you leave employment.

- Tax advantages – invest money in mutual funds to grow your tax savings for either future healthcare costs or retirement.

- Pay for expenses with a benefits debit card that gives you immediate access to your money at the time of purchase.

- Expenses also can be reimbursed through our online portal, online bill pay directly to your provider or submitting a distribution request form.

- Receipts are not required for reimbursement but be sure to save them for tax purposes.

Who Can Participate in an HSA?

-

- You must be enrolled in a qualified High Deductible Health Plan (HDHP).

- You cannot be enrolled in Tricare or Medicare or covered under your spouse’s traditional (non-HDHP) health care plan.

- You cannot participate in a general purpose Flexible Spending Account (FSA) or Health Reimbursement Arrangement.

- Limited Purpose Flexible Spending Accounts are permitted (dental and vision expenses only).

- You cannot participate if your spouse has a general purpose FSA or HRA at their place of employment.

- You cannot participate if you are being claimed as a dependent on another person’s tax return.

HSA Resources

-

Benefits Card

The FFGA Benefits Card is available to all employees that participate in a Flexible Spending Account or Health Savings Account. The Benefits Card gives you immediate access to your money at the point of purchase. Cards are available for participating employees, their spouse and any eligible dependents who are at least 18 years old. The IRS requires validation of most transactions for FSAs. You must submit receipts for validation of expenses when requested. If you fail to substantiate by providing a receipt to First Financial within 60 days of the purchase or date of service your card will be suspended until the necessary receipt or explanation of benefits from your insurance provider is received.

View Your Account Details Online

Sign up to view your account balance, find tax forms and check claims status on our secure website. Log in at www.ffga.com. After you log in, you may sign up to have reimbursements directly deposited to your bank account.

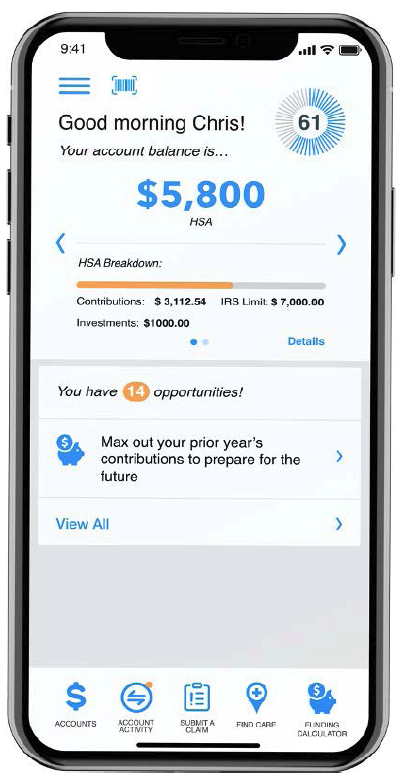

FF Mobile Account App

With the FF Mobile Account App, you can submit claims, view account balance and history, check claims status, view alerts, upload receipts and documentation and more! The FF Mobile Account App is available for Apple® and Android™ devices on either the App Store or Google Play Store.

FFA/HSA Store

FFGA has partnered with the FSA Store and HSA Store to bring you easy-to-use online stores to better understand and manage your account. You can shop for eligible medical items like bandages and contact solution, browse for products and services using the Eligibility List and visit the Learning Center to find answers to commonly asked questions. Visit the stores at http://www.ffga.com/individuals/#stores for more details and special deals.

Questions?

-

Harris County Department of Education

Benefits Office

6300 Irvington Blvd.

Houston, TX 77022

Email: benefits@hcde-texas.org

Phone: 713-696-8284Erika Ibarra

HCDE Benefits Coordinator

Email: erika.ibarra@hcde-texas.org

| Contribution Limits and Deductibles | 2025 Calendar Year | 2024 Calendar Year |

|---|---|---|

| HSA Contribution Limit | ||

| HDHP Minimum Deductibles |

-

$1000 catch-up contributions (age 55 or older)