Divisions

In the Spotlight

-

Drive change for Harris County students!

Join us Friday, Nov. 14, for the first-ever Education Foundation of Harris County Topgolf Tournament

-

Fall into learning with CASE for Kids

From drones to kindness campaigns, explore a season of dynamic trainings designed to inspire, educate, and elevate your program

-

Join Head Start for a day of mental wellness

The Healthy Minds, Healthy Families Conference returns October 24 with expert insights and practical tools

-

Fortis makes recovery education free for area districts

Tuition-free model helps students reclaim their futures

-

Work that adds up to more

Dual retirement programs, top ranking salaries just a few reasons people love working here!

-

Series opens dialogue on student well-being

Monthly virtual sessions equip educators with tools to support mental health in schools. Free registration and CE credits available.

-

Start the school year strong

Hear from after-school pros on building confidence, connection, and quality in youth programs

-

A Sandy Hook parent's mission to make schools safer

Our guest, Carly Posey, shares how she's helping schools build a culture of safety through education, reunification, and communication

-

Learn about the perks of being a member of Choice Partners

Enhance your purchasing power! Our podcast explains the membership process and the significant benefits of joining Choice Partners

-

Learn all about grants on HCDE's new podcast series

Focus on Funding is your resource for grant essentials, perfect for anyone eager to learn about securing funding for their programs

HCDE In Motion

Latest News

-

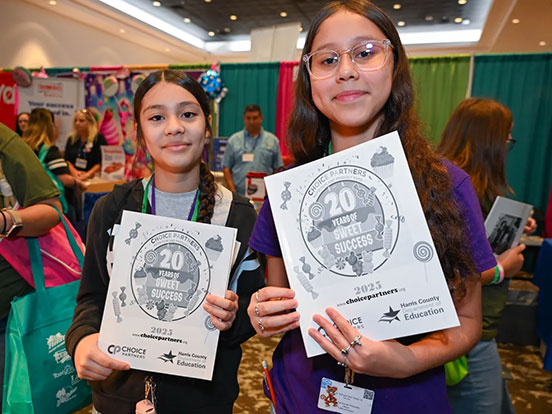

Choice Partners celebrates 20 years with sweet success at annual expo

More than 140 vendors and 200 students joined the celebration, sampling new products and shaping future school menus

-

SuperMENtors Campaign kicks off at HCDE's Head Start campuses

Dozens of male volunteers begin monthly reading visits to inspire Harris County’s youngest learners

Upcoming Events & Workshops

-

10:00 AM - 12:00 PM CASE for Kids Workshop: Beyond the Worksheets: Making Homework Help Meaningful

-

Monday

-

October 31, 2025

-

November 4, 2025

7:00 AM - 7:00 PM Election Day

-

November 7, 2025

10:00 AM - 12:00 PM CASE for Kids Workshop: Smooth Transitions: Planning for the In-between Time in OST

-

November 13, 2025

11:00 AM Let's Talk Mental Health Series: Stress Awareness and Coping

-

November 14, 2025

-

10:00 AM - 12:00 PM CASE for Kids Workshop: 3, 2, 1... Launch

-

12:00 PM - 3:00 PM EFHC Topgolf Tournament

-

November 19, 2025

-

November 20, 2025

10:00 AM - 12:00 PM CASE for Kids Workshop: The Leadership Blueprints: Planning for Youth Leadership in OST

-

November 21, 2025

-

November 24, 2025

-

November 25, 2025

-

November 26, 2025

-

November 27, 2025

-

November 28, 2025

-

December 2, 2025

-

December 5, 2025

10:00 AM - 12:00 PM CASE for Kids Workshop: Visualize Purpose-Align Goals-Inspire Growth

-

December 11, 2025

11:00 AM Let's Talk Mental Health Series: Overcoming Seasonal Depression

-

December 17, 2025

-

December 19, 2025

Harris County Department of Education

This notice concerns the 2025 property tax rates for Harris County Department of Education. This notice provides information about two tax rates used in adopting the current tax year's tax rate. The no-new-revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years. In most cases, the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election. In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. The rates are given per $100 of property value.

| This year's no-new-revenue tax rate | $0.004725/$100 |

| This year's voter-approval tax rate | $0.005127/$100 |

Let's Get Social